简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker Assessment Series | LiteForex: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of LiteForex, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of LiteForex, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2008, LiteForex operates as an online brokerage offering the trading of exchange-traded CFDs.

The company offers a diverse range of tradable assets, including currency pairs, commodities, and global indices.

Types of Accounts:

LiteForex offers two account options: the ECN Account and the Classic Account.

Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

LiteForex offers a range of payment options, including wire transfer, MasterCard, Visa, Maestro, Skrill, and Neteller.

Trading Platforms:

LiteForex provides the MetaTrader (MT4) trading platform, available on PC, mobile, and web, is widely used in the industry. MetaTrader 4 is an advanced trading platform offering a comprehensive suite of features and tools for precise trading analysis. With one-click trading, quick order execution, VPS hosting, and up to four pending order types along with trailing stops, it provides a highly customizable interface with thousands of online tools to plug in. The platform supports fully customizable and in-depth charts, in-depth trading history, and allows users to build or import Expert Advisors (EAs), enabling the automation of trading strategies.

Research and Education:

LiteForex offers a ‘Tutorial’ section that provides educational resources to support traders at different levels, including beginners, intermediate, and advanced. These resources are available in the form of texts.

Customer Service:

LiteForex provides customer service support in several foreign languages, including English, Polish, Portuguese, and others, through its live chat function, email (support@liteforex.eu), and phone (+357 25 750 555).

Conclusion:

To summarize, here's WikiFX's final verdict:

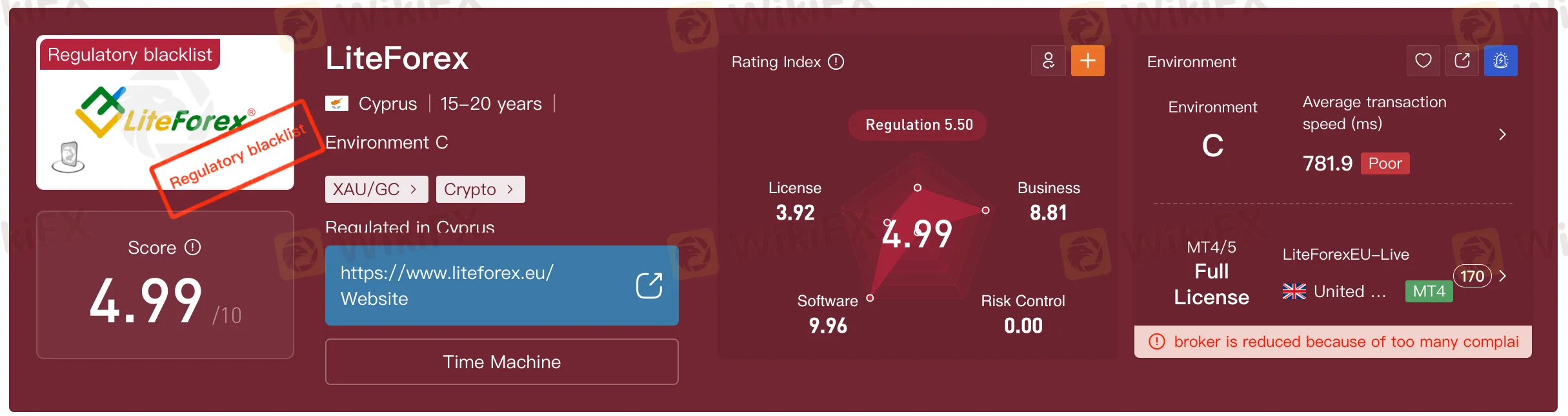

WikiFX, a global forex broker regulatory platform, has assigned LiteForex a WikiScore of 4.99 out of 10.

Upon reviewing LiteForex's licensing credentials, WikiFX confirmed that the broker is regulated by Cyprus Securities and Exchange Commission (CySEC). WikiFX has verified the authenticity of this license.

However, LiteForex has received several complaints from users worldwide and has been added to the warning list of Malaysias Securities Commission, casting doubt on its trustworthiness.

In addition, WikiFX‘s global field survey team paid a physical visit to LiteForex’s office in Cyprus, and it was reported that no office was found, suggesting that the information stated on its website isn't legitimate.

Therefore, WikiFX advises users to choose a broker with a higher WikiScore for greater credibility and security.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Trade Nation: A Closer Look at Its Licences

In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Trade Nation and its licenses.

What Xtreme Markets Isn’t Telling You About Its Regulation

Xtreme Markets, a forex and CFD broker, operates under a licence issued by the Financial Services Commission (FSC) of Mauritius. While this regulatory stamp may appear reassuring at first glance, a closer look at the nature of offshore licences reveals several critical factors that investors should not ignore.

Trapped Capital: Complaints Exposing OctaFX’s Questionable Practices

Traders across Asia are sounding the alarm as OctaFX is accused of freezing accounts, blocking withdrawals, and leaving users helpless, raising urgent concerns that your money might not be safe.

FINRA Fines Rialto Markets $50,000 for Cybersecurity and Supervisory Failures

Rialto Markets LLC, a FINRA-registered broker-dealer headquartered in New York, has agreed to pay a $50,000 fine and accept a censure in a settlement with the Financial Industry Regulatory Authority (FINRA) over serious deficiencies in safeguarding customer information.

WikiFX Broker

Latest News

Gold Prices Waver as Fundamentals Remain in Tug-of-War

Know the history of "Bank of India" before Investing — then Trade Confidently

AMarkets is an Unregulated Broker | You Must Know the Risks

FCA Warning List is Out: Check if Your Broker is on the List

Trading via Unauthorized Brokers? A Penalty of Up to INR 2 Lakh Awaits You!

How to Choose the Right VPS for Forex Trading

Still Falling for BotBro’s 60% Annual Forex Returns? Wake Up Before It Gets Too Late!

Webull Adds Crypto Trading Through Kalshi Partnership

Investment Scam Exposed: Deepfake Videos of Top Indian Leaders & Tech Icons misused to Lure Investor

Global Introducing Broker Growth Sharing Campaign

Currency Calculator